Which of the Following Statements Accurately Describes a Fidelity Bond

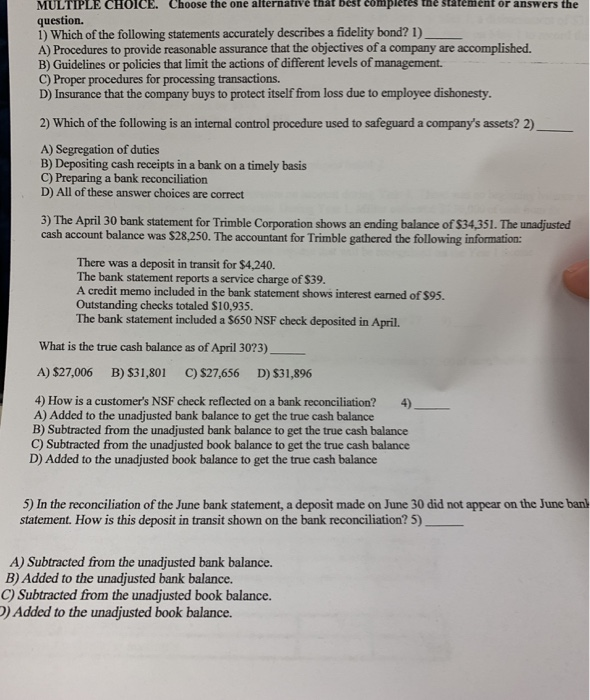

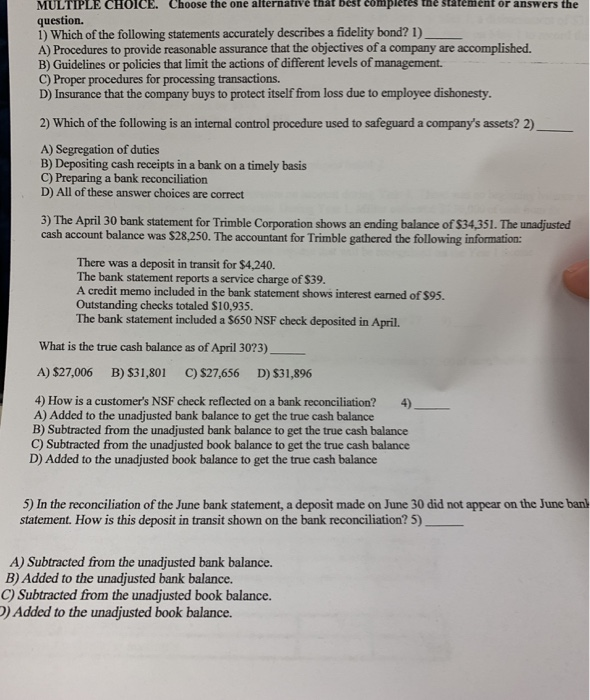

Which of the following statements about the Securities Act of 1933 is not true. C A zero coupon is a bond that is secured by a lien on real property.

11 Which Of The Following Is Not A Generally Recognized Internal Control Procedure A Establishment Of Clear Lines Of Authority B Customer Service Comment Cards C Requiring Regular Vacations Study Com

Let me know if you need any clarification correct answer is option.

. Fidelity bonds _____. First Fidelity will process the payments for a fee of 015 per payment with no compensating balance required. Prevent and detect embezzlement are a type of insurance policy may include employee background.

Which of the following statements accurately describes this structure. Insurance that the company buys to protect itself from loss due to employee dishonesty. For example a bond with a 10 coupon will pay 100 per 1000 of the bonds face value per year subject to credit risk.

Which of the following statements accurately describes a fidelity bond. Which of the following statements accurately describes a fidelity bond. Insurance that the company buys to protect itself from loss due to employee dishonesty.

Use the following to answer questionsIndicate how each event affects the elements of financial statementsUse the following letters to record your answer in. When searching Fidelitys secondary market fixed income offerings. Procedures to provide reasonable assurance that the objectives of a company are accomplished.

The King Surety Company wrote a general fidelity bond covering thefts of assets by the challenging employees of Wilson Inc. Insurance that the company buys to protect itself from loss due to employee dishonesty. Cash received from the sale of stocks or bonds and the actual cash paid to others in.

B A bond will sell at a premium if the prevailing required rate of return is less than the bonds coupon rate. The bank statement included a 650 NSF check deposited in April. Asked Jan 2 2020 in Business by hquerns.

Insurance that the company buys to protect itself from loss due to employee dishonesty. Paid cash dividends would be classified as aan a. The interest rate a bonds issuer promises to pay to the bondholder until maturity or other redemption event generally expressed as an annual percentage of the bonds face value.

Proper procedures for. Please find below the solution. 27Which of the following statements accurately describes a fidelity bond.

Proper procedures for processing transactions. Insurance that the company buys to protect itself from loss due to employee dishonesty. Diego paid 47 for 3 tickets to a concert.

2 Insurance that the company buys to protect itself from loss due to employee dishonesty Proper procedures for processing accounting transactions Procedures to provide reasonable assurance that the objectives of a company are accomplished. Question Which of the following statements accurately describes a fidelity bond. Which of the following statements accurately describes a fidelity bond.

Which Of The Following Statements Accurately Describes A Fidelity Bond. Andre paid 141 for 9 tickets to a concert. 1The SML approach is dependent upon a reliable measure of a firms unsystematic risk.

Question Which of the following statements are correct. Which of the following most accurately describes fraud. Absence of reasonable care.

A A bond that has a rating of AA is considered to be a junk bond. 2 Insurance that the company buys to protect itself from loss due to employee dishonesty Proper procedures for processing accounting transactions Procedures to provide reasonable assurance that the objectives of a company are accomplished. The bank statement reports a service charge of 39.

The fidelity of the genetic code relies on a set of aminoacyl tRNA synthases that. Outstanding checks totaled 10935. There was a deposit in transit for 4240.

Peptide bonds in this structure were formed via hydrolysis reactions. Lack of slight care. Proper procedures for processing transactions.

Fedility bond cover the risk of dishonest employee. Which of the following statements is true. Insurance that the company buys to protect itself from loss due to employee dishonesty.

Which of the following statements accurately describes an efficient tax plan. Insurance that the company buys to protect itself from loss due to employee dishonesty. Have offered to process Zacks retail charge card payments.

A credit memo included in the bank statement shows interest earned of 95. Hydrogen bonding between carbonyl oxygens and amide hydrogens in different strands stabilizes this structure. The accountant for Trimble gathered the following information.

Which of the following statements accurately describes a fidelity bond. Fidelity bonds is a form of insurance protection covering the policyholders from the losses that may arise due to fraudulent acts by a specified individual or employee. Procedures to provide reasonable assurance that the objectives of a company are accomplished.

Which of the following statements accurately describes a fidelity bond.

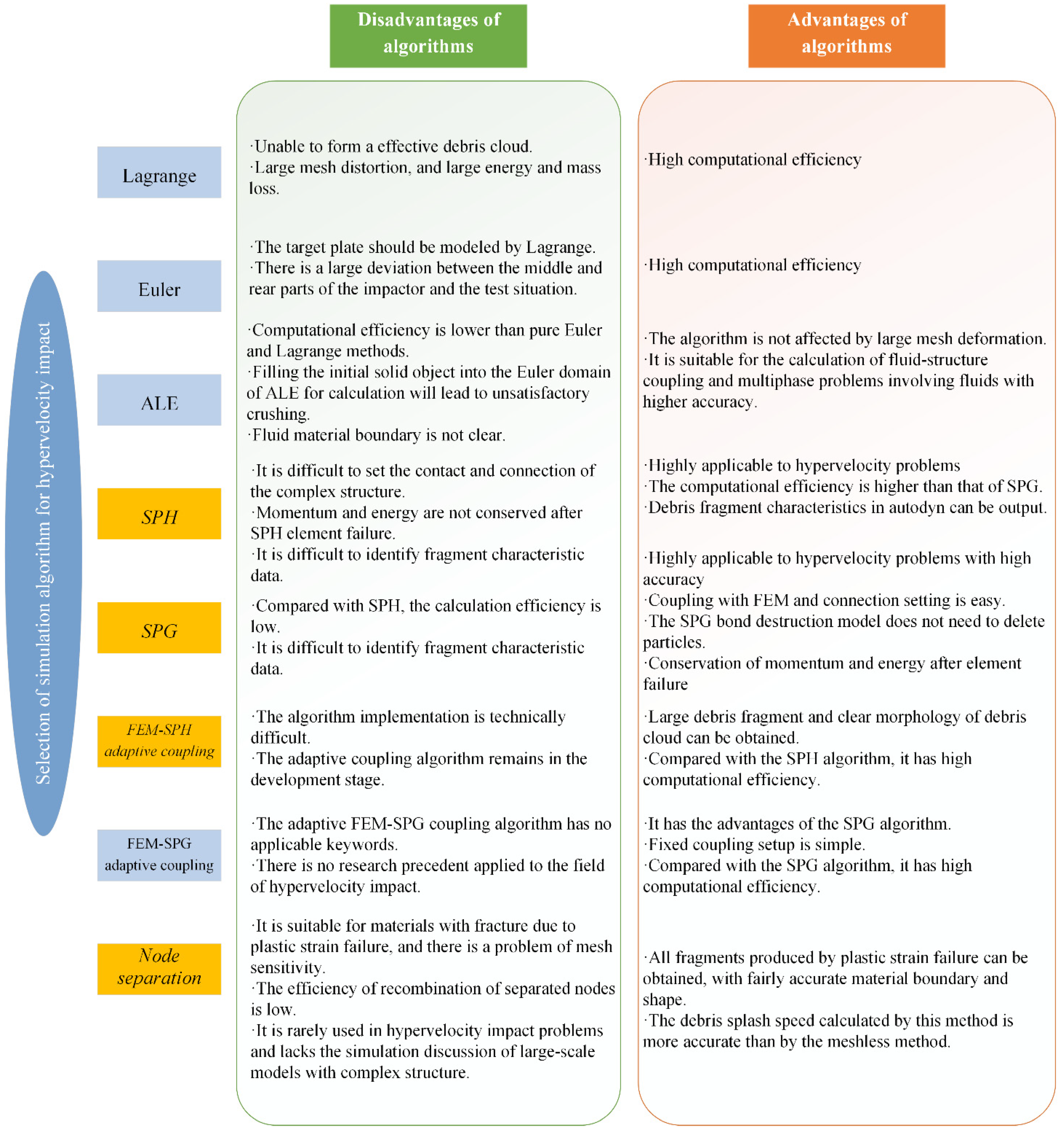

Aerospace Free Full Text Study On Numerical Simulation Methods For Hypervelocity Impact On Large Scale Complex Spacecraft Structures Html

Accounting Test Chapter 6 Flashcards Quizlet

Settling Velocity An Overview Sciencedirect Topics

Solved Multiple Choice Choose The One Alternative That Best Chegg Com

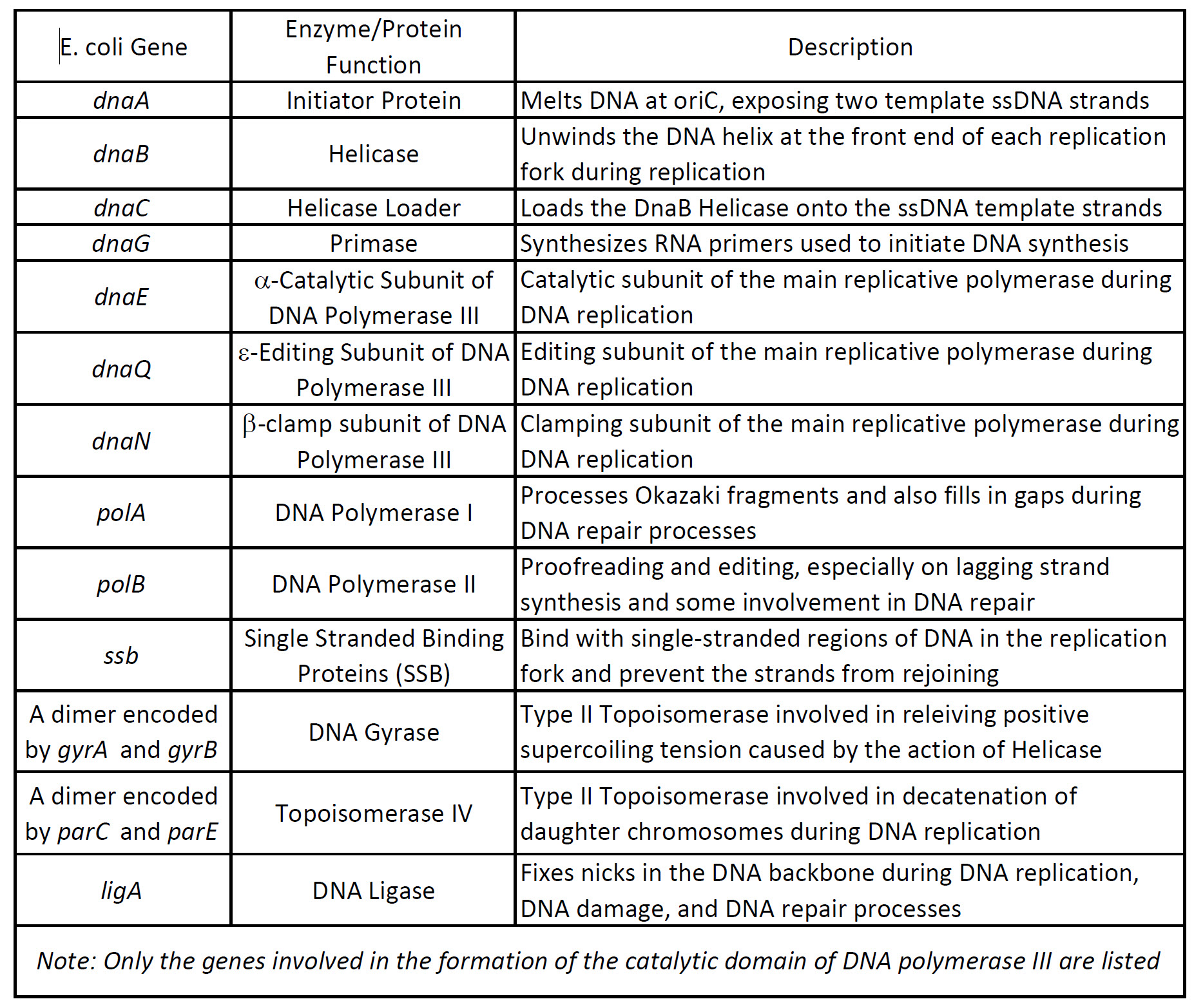

Chapter 9 Dna Replication Chemistry

The Management Of Tax Risks In Mergers And Acquisitions The Importance Of Tax Due Diligence Intechopen

Solved Which Of The Following Statements Accurately Chegg Com

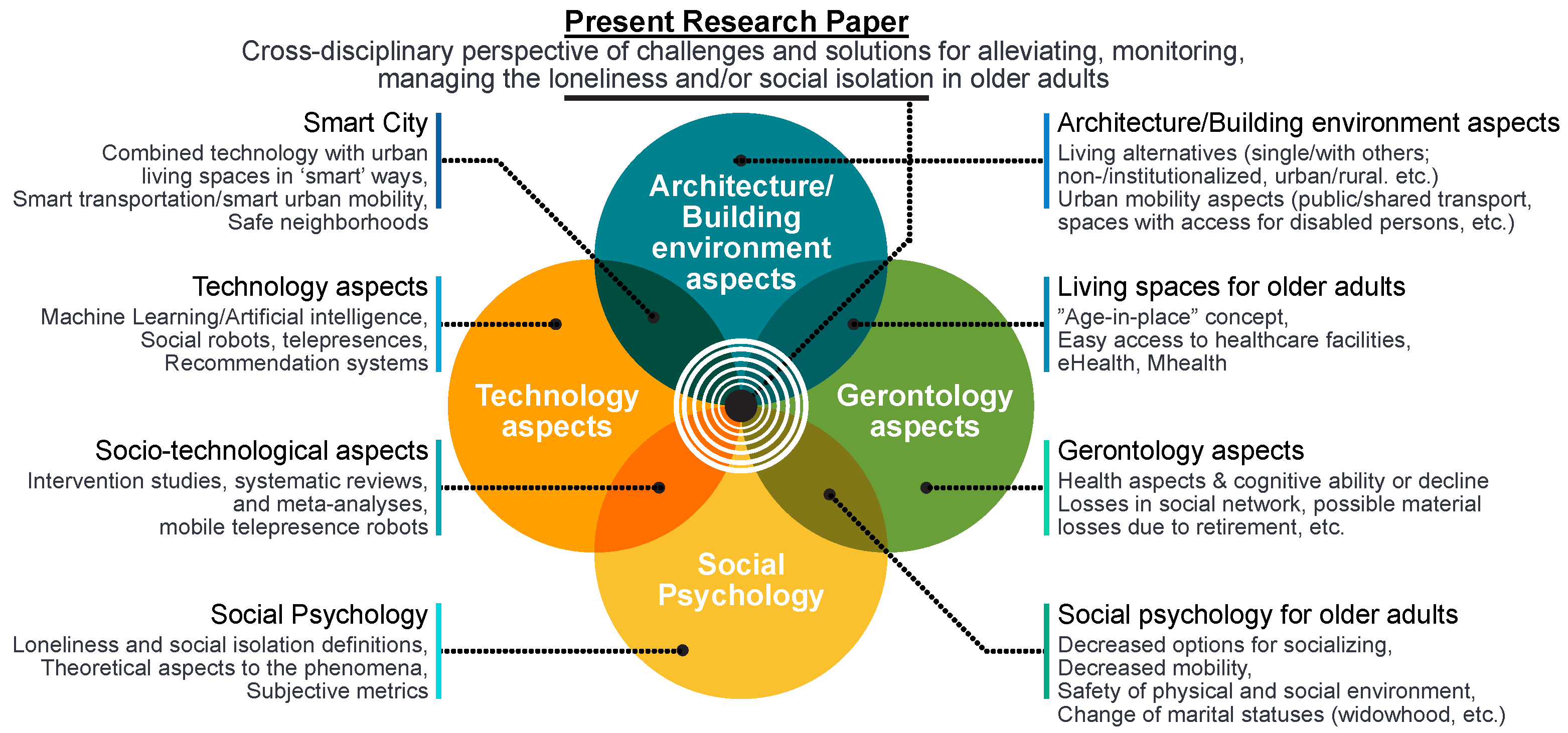

Sensors Free Full Text Managing Perceived Loneliness And Social Isolation Levels For Older Adults A Survey With Focus On Wearables Based Solutions Html

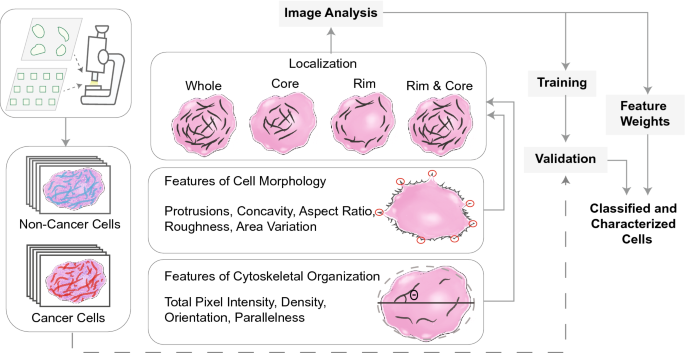

Morphological Features Of Single Cells Enable Accurate Automated Classification Of Cancer From Non Cancer Cell Lines Scientific Reports

Introduction In Critical Reflections On Poetry And Painting 2 Vols

Comments

Post a Comment